Simplify Your Tax Management with Fusion ETRM’s Advanced Module

Complexities of Commodity and Energy Trading Taxation

Commodity and Energy trading taxation is very complex and requires regular updates in rates, tax rules, regulations, inclusion and exclusion lists which are required to be managed across multiple trade types, jurisdiction, products etc. Generally trading organizations assume their ETRM system comes with tax engine which will handle these complex structures of taxes and their regular maintenance work for frequent updates. After all, ETRM systems are designed to generate cashflow transactions and invoices, right?

The Gap in Standard ETRM Systems

However, most of them do not have the capabilities. The standard tax structure that comes with most ETRM systems are not built to handle the complex nature of taxes. The potential implications are significant, Even a single failure of posting correct taxes and exempted transactions will lead to an adverse impact on the company’s adherence to tax regulations and will attract increased audit risks and tax liabilities.

Fendahl's Fusion Tax Rates Module: A Solution

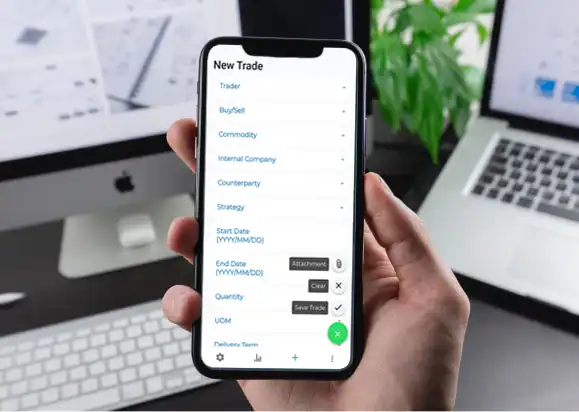

Fendahl’s Fusion tax rates module simplifies complex tax management. Offering an easy to use structure for end users. Allowing for straightforward creation and maintenance of tax data, ensuring smooth updates whenever needed.

Once a physical trade is executed in the system, Fusion starts generating projected taxes and other fees based on contractual information. Once the system records the details of physical trade operations the system reevaluates these taxes based on real data.

Comprehensive Tax Rule Configuration

The tax rates module of Fusion ETRM handles the setup of tax rules with a host of variables such as:

- Buy/Sell

- Products

- Product Type – Dyed vs Clear

- Origin

- Final Destination

- Title Transfer Location

- Counterparty

- Tax Jurisdiction

- Applicable period – which can be based on title transfer date, BL date etc.

Using all these variables, the Fusion ETRM system enables the definition of tax rules with inclusion and exclusion list. This feature allows the selection of single or multiple values to effectively setup tax rates, including exemption lists.

Enhanced Flexibility and Tax Management Features

Additionally, the system can configure taxes for different modes of transport (MOT), as excise taxes and federal taxes often vary based on transportation methods. It also facilitates setting tax rules for products based on their specifications, such as dyed versus clear products.

Another distinctive feature of the Fusion tax rate module is its capability to manage pass-through taxes, allowing your organization to handle taxes for partners and settle them with entities like NORA, Internal Revenue Services and various State agencies and Federal agencies.

Moreover, Fusion allows various setups for applicable tax rates, accommodating percentages based on the products value or fixed rates based on volume, among others. Despite the range of options and detailed configurations available, the tax rate module is designed with simplicity in mind, enabling end users to manage it effortlessly without needing deep technical knowledge.

Comprehensive Tax Compliance and Monitoring

Thanks to these comprehensive capabilities, our clients can easily establish tax rules for a wide array of regulations, including but not limited to LUST tax, SPILL tax, NORA fees, Excise tax, Sales tax, NY Article 13-A tax, as well as Biofuel tax credits. The possibilities are extensive. Furthermore, the module’s utility extends beyond handling just direct and indirect taxes; it’s adept at configuring any transaction fees dependent on specific conditions or variables. For instance if a trade agreement stipulates delivering dyed diesel within a certain timeframe but the delivery includes cold flow additives, the tax rate module can automatically adjust the cashflow to account for the additional charge.

In essence, Fusion’s advanced tax rate module equips our clients with robust tools for managing their liabilities and cash flows transparently, mitigating the need for in-house tax expertise, constant monitoring of tax regulations, and significantly reducing risk of tax-related errors and compliance issues.

Ensuring Accurate Invoicing and Compliance

In a summary, the tax rates module of the Fusion provides:

- Fast and precise calculation of all direct and indirect taxes

- Easy monitoring of cashflow related to taxes and their tax codes

- Frequent updates and adjustments for changes in tax codes

- Determine and calculate indirect taxes due on any energy transaction

- Handle monthly rule and rate updates and ensure on-going tax accuracy

- Track counterparty licenses and exemptions, further ensuring tax accuracy

- Handle complex tax rules as well as custom fees applicable to energy trades

- Ensure accurate invoicing and government compliance

More To Explore

Dairy Products, Inc. Partners with Fendahl to Implement Fusion CTRM Solution

Dairy Products, Inc. Partners with Fendahl to Implement Fusion CTRM Solution Eden Prairie, Minn., June 20th, 2024 – Fendahl announces that Dairy Products, Inc. (DPI),

US Based Oil & Gas Trader, Rio Energy, Selects Fendahl Fusion CTRM Software

US Based Oil & Gas Trader, Rio Energy, Selects Fendahl Fusion CTRM Software Fendahl are proud to announce that Rio Energy International Inc. (Rio Energy)